How to Use Robo-Advisors for Retirement Planning

How to Use Futures Contracts for Hedging

The Role of AI in Financial Planning

How to Save Money on Home Energy Bills

How to Invest in Gold and Precious Metals

Apr 24, 2025 By Juliana Daniel

Why Invest in Gold and Precious Metals?

Gold and precious metals have been a cornerstone of wealth preservation for centuries. Unlike fiat currencies, which can be devalued by inflation, gold maintains its intrinsic value over time. Precious metals like silver, platinum, and palladium also offer unique benefits, from industrial applications to portfolio diversification. Investing in these assets can act as a hedge against economic uncertainty, currency devaluation, and market volatility. Whether you're a seasoned investor or just starting, understanding the role of gold and precious metals in your portfolio is essential for long-term financial security.

Understanding the Different Forms of Gold Investment

Gold can be invested in various forms, each with its own advantages and considerations. Physical gold, such as coins, bars, and jewelry, offers tangible ownership but requires secure storage. Gold ETFs (Exchange-Traded Funds) and mutual funds provide exposure to gold prices without the need for physical storage. Gold mining stocks and futures contracts are more complex and involve higher risk but can offer significant returns. Understanding these options allows you to choose the investment method that aligns with your financial goals, risk tolerance, and level of involvement.

The Role of Silver in a Diversified Portfolio

Silver is often overshadowed by gold, but it plays a crucial role in a diversified investment strategy. It is more affordable than gold, making it accessible to a broader range of investors. Silver also has significant industrial applications, particularly in electronics and renewable energy, which can drive demand. Like gold, silver can be purchased in physical form, ETFs, or mining stocks. Its dual role as both a precious metal and an industrial commodity makes it a versatile asset that can perform well in various economic conditions.

Platinum and Palladium: The Lesser-Known Precious Metals

Platinum and palladium are often overlooked but offer unique opportunities for investors. Platinum is rarer than gold and has applications in jewelry, automotive catalysts, and industrial processes. Palladium, on the other hand, is essential for catalytic converters in vehicles, making it highly sensitive to changes in the automotive industry. Both metals can be volatile but provide excellent diversification benefits. Investing in these metals can be done through physical bullion, ETFs, or shares in mining companies. Their specialized uses make them an intriguing addition to any precious metals portfolio.

How to Buy Physical Gold and Precious Metals

Purchasing physical gold and precious metals requires careful consideration of factors like purity, weight, and authenticity. Reputable dealers and mints are the best sources for buying bullion coins and bars. It's essential to verify the dealer's credentials and understand the premiums charged above the spot price. Storage is another critical aspect; options include home safes, bank safety deposit boxes, or professional vaulting services. While physical ownership provides security, it also comes with responsibilities like insurance and maintenance.

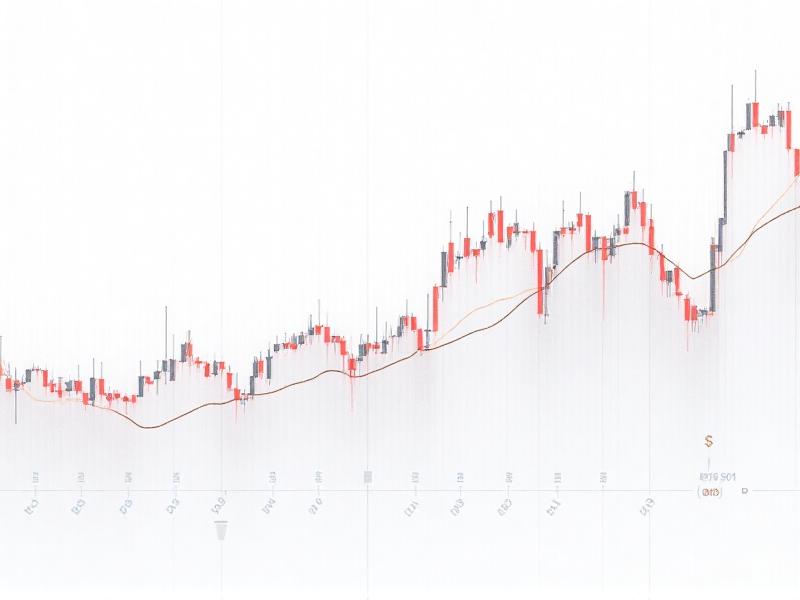

Exploring Gold ETFs and Mutual Funds

For investors who prefer not to handle physical gold, ETFs and mutual funds offer a convenient alternative. Gold ETFs track the price of gold and can be traded like stocks on exchanges. Mutual funds invest in a diversified portfolio of gold-related assets, including mining companies. These options provide liquidity and eliminate the need for storage. However, they come with management fees and may not offer the same level of security as physical ownership. Understanding the pros and cons of these instruments is crucial for making informed investment decisions.

Risks and Rewards of Gold Mining Stocks

Investing in gold mining stocks can be highly rewarding but comes with significant risks. These stocks are influenced not only by gold prices but also by factors like operational efficiency, geopolitical risks, and environmental regulations. While successful mining companies can offer substantial returns, poorly managed ones can lead to losses. Diversifying within the sector and conducting thorough research are essential strategies for mitigating risks. For those willing to take on higher volatility, gold mining stocks can be a lucrative addition to a precious metals portfolio.

The Impact of Global Economic Trends on Precious Metals

Global economic trends play a significant role in the performance of precious metals. Inflation, interest rates, and geopolitical events can drive demand for gold as a safe-haven asset. Economic growth, particularly in emerging markets, can boost demand for industrial metals like silver, platinum, and palladium. Understanding these dynamics helps investors anticipate price movements and make strategic decisions. Staying informed about macroeconomic indicators and global developments is crucial for maximizing returns on precious metals investments.

Tax Implications of Investing in Gold and Precious Metals

Investing in gold and precious metals has specific tax implications that vary by country and investment form. Physical gold may be subject to sales tax or capital gains tax when sold. ETFs and mining stocks are typically taxed as investments, with rates depending on holding periods and jurisdiction. It's essential to consult a tax professional to understand the rules and optimize your tax strategy. Proper tax planning ensures that you retain more of your investment returns and avoid unexpected liabilities.

Building a Long-Term Strategy for Precious Metals Investment

A successful precious metals investment strategy requires a long-term perspective and disciplined approach. Diversifying across different metals and investment forms can reduce risk and enhance returns. Regularly reviewing your portfolio and rebalancing as needed ensures alignment with your financial goals. Staying informed about market trends and economic developments helps you make timely decisions. Whether you're investing for wealth preservation, portfolio diversification, or speculative gains, a well-thought-out strategy is key to achieving your objectives.

How to Invest in Value Stocks for Long-Term Gains

The Role of Research in Making Informed Investments

The Future of Peer-to-Peer Insurance

How to Use ETFs for Environmental, Social, and Governance (ESG) Investing

How to Invest in ESG (Environmental, Social, Governance) Funds

The Role of AI in Wealth Management

How to Use Options for Income Generation

Unforgettable Pilgrimages: Top Temples in Andhra Pradesh

Advertisement