How to Save Money on Home Energy Bills

The Financial Impact of Social Comparisons

How Blockchain is Revolutionizing Finance

How to Invest in Value Stocks for Long-Term Gains

How to Use Robo-Advisors for Retirement Planning

Apr 24, 2025 By Juliana Daniel

Understanding Robo-Advisors: A Modern Approach to Retirement Planning

Robo-advisors have revolutionized the way individuals approach retirement planning. These automated platforms use algorithms to manage investments, offering a cost-effective and efficient alternative to traditional financial advisors. By leveraging technology, robo-advisors provide personalized investment strategies tailored to your financial goals, risk tolerance, and time horizon.

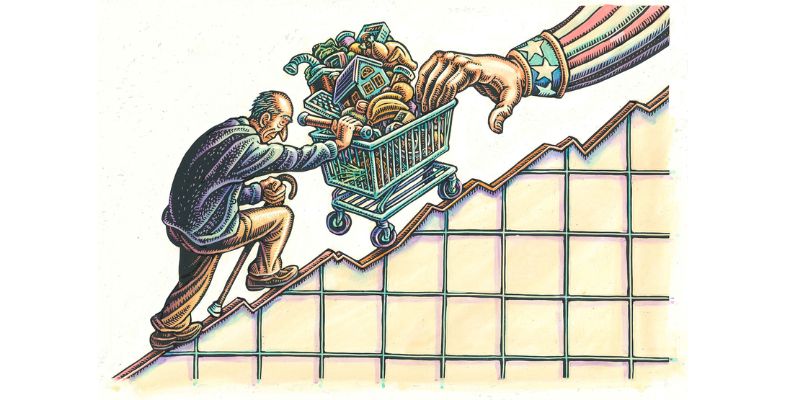

One of the key advantages of robo-advisors is their accessibility. Unlike traditional advisors, who often require a high minimum investment, robo-advisors are available to investors with varying levels of capital. This democratization of financial advice makes it easier for individuals to start planning for retirement, regardless of their current financial situation.

Additionally, robo-advisors are designed to be user-friendly. Most platforms feature intuitive interfaces that guide users through the process of setting up an account, selecting investment options, and monitoring their portfolio. This ease of use is particularly beneficial for those who may not have extensive knowledge of financial markets or investment strategies.

How Robo-Advisors Work: The Technology Behind the Scenes

At the core of every robo-advisor is a sophisticated algorithm that analyzes your financial data to create a customized investment plan. When you sign up for a robo-advisor, you’ll typically be asked to complete a questionnaire that assesses your financial goals, risk tolerance, and investment horizon. Based on your responses, the algorithm will recommend a portfolio that aligns with your objectives.

Robo-advisors often employ a strategy known as Modern Portfolio Theory (MPT), which aims to optimize returns by diversifying investments across various asset classes. This diversification helps to mitigate risk, ensuring that your portfolio is well-balanced and capable of weathering market fluctuations. The algorithm continuously monitors your investments and automatically rebalances your portfolio to maintain the desired asset allocation.

Another important feature of robo-advisors is their use of low-cost index funds and ETFs (Exchange-Traded Funds). These investment vehicles are known for their low fees and broad market exposure, making them an ideal choice for long-term retirement planning. By minimizing costs, robo-advisors help you maximize your returns over time.

Benefits of Using Robo-Advisors for Retirement Planning

Robo-advisors offer several advantages that make them an attractive option for retirement planning. One of the most significant benefits is their cost-effectiveness. Traditional financial advisors typically charge a percentage of your assets under management, which can add up over time. In contrast, robo-advisors charge much lower fees, often ranging from 0.25% to 0.50% annually, making them a more affordable option for long-term investors.

Another advantage is the convenience they offer. With a robo-advisor, you can manage your investments from the comfort of your home, using your computer or smartphone. This eliminates the need for in-person meetings and allows you to stay on top of your retirement planning without disrupting your daily routine. Additionally, robo-advisors provide 24/7 access to your portfolio, so you can monitor your investments at any time.

Robo-advisors also excel in providing personalized investment strategies. By analyzing your financial data and preferences, these platforms can create a portfolio that is tailored to your unique needs. This level of customization ensures that your retirement plan is aligned with your goals, whether you’re looking to grow your wealth, preserve capital, or generate income during retirement.

Choosing the Right Robo-Advisor for Your Retirement Goals

With so many robo-advisors available, it’s important to choose one that aligns with your retirement goals and financial situation. Start by considering the fees charged by the platform. While most robo-advisors are cost-effective, some may offer additional services, such as access to human advisors, which could come at a higher cost. Evaluate whether these services are worth the extra expense based on your needs.

Next, look at the investment options offered by the robo-advisor. Some platforms provide a wide range of asset classes, including stocks, bonds, and alternative investments, while others may focus on a more limited selection. Ensure that the robo-advisor you choose offers the types of investments that align with your retirement strategy.

Finally, consider the level of customer support provided by the platform. While robo-advisors are largely automated, having access to human support can be valuable, especially if you have questions or need assistance with your account. Look for a platform that offers robust customer service, including phone, email, and chat support, to ensure that you have the help you need when you need it.

Maximizing Your Retirement Savings with Robo-Advisors

To get the most out of your robo-advisor, it’s important to take an active role in managing your retirement savings. Start by regularly contributing to your account. Many robo-advisors offer automatic contribution features, allowing you to set up recurring deposits from your bank account. This ensures that you’re consistently building your retirement fund over time.

Another key strategy is to take advantage of tax-efficient investment options. Some robo-advisors offer tax-loss harvesting, a feature that automatically sells losing investments to offset gains, thereby reducing your tax liability. Additionally, consider contributing to tax-advantaged accounts, such as IRAs or 401(k)s, which can provide significant tax benefits and help you grow your retirement savings more effectively.

Finally, regularly review and adjust your investment strategy as needed. While robo-advisors automatically rebalance your portfolio, it’s still important to periodically assess your financial goals and risk tolerance. Life changes, such as a new job, marriage, or the birth of a child, may require you to adjust your retirement plan. By staying engaged with your investments, you can ensure that your retirement strategy remains on track.

Common Mistakes to Avoid When Using Robo-Advisors for Retirement Planning

While robo-advisors offer many benefits, there are some common mistakes that investors should avoid. One of the most significant errors is not providing accurate information when setting up your account. The algorithm relies on your input to create a personalized investment strategy, so it’s crucial to be honest about your financial goals, risk tolerance, and investment horizon. Providing inaccurate information can lead to a portfolio that doesn’t align with your needs.

Another mistake is neglecting to review your portfolio regularly. Although robo-advisors automatically rebalance your investments, it’s still important to periodically assess your financial situation and make adjustments as needed. Life changes, such as a new job, marriage, or the birth of a child, may require you to update your retirement plan. Failing to do so could result in a portfolio that no longer meets your goals.

Finally, don’t overlook the importance of diversification. While robo-advisors typically create well-diversified portfolios, some investors may be tempted to concentrate their investments in a particular asset class or sector. This can increase your risk and potentially lead to significant losses. Stick to the diversified portfolio recommended by your robo-advisor to ensure that your investments are well-balanced and capable of weathering market fluctuations.

The Future of Retirement Planning: How Robo-Advisors Are Evolving

As technology continues to advance, robo-advisors are becoming increasingly sophisticated. One of the most exciting developments is the integration of artificial intelligence (AI) and machine learning. These technologies enable robo-advisors to analyze vast amounts of data and make more accurate predictions about market trends and investment opportunities. This can lead to more personalized and effective retirement planning strategies.

Another trend is the incorporation of environmental, social, and governance (ESG) criteria into investment portfolios. Many robo-advisors now offer ESG-focused options, allowing investors to align their retirement savings with their values. This is particularly appealing to younger investors, who are increasingly prioritizing sustainability and social responsibility in their financial decisions.

Additionally, the future of robo-advisors may include more hybrid models that combine automated investment management with access to human advisors. This approach offers the best of both worlds, providing the convenience and cost-effectiveness of robo-advisors with the personalized guidance of a financial professional. As these trends continue to evolve, robo-advisors are likely to play an even more significant role in retirement planning.

The Financial Benefits of a Digital Detox

The Role of Financial Planning in Career Transitions

Unforgettable Pilgrimages: Top Temples in Andhra Pradesh

A Comprehensive Guide to Trading Options in Roth IRAs

How to Use Futures Contracts for Hedging

How to Invest in ESG (Environmental, Social, Governance) Funds

Social Security and Cost-of-Living Adjustments (COLA)

The Pros and Cons of Digital Banking

Advertisement