Social Security and Cost-of-Living Adjustments (COLA)

The Financial Impact of Social Comparisons

How to Choose the Right Hostel: 6 Tips to Avoid Bad Stays

How to Save Money on Home Appliances

The Financial Impact of Social Comparisons

Apr 24, 2025 By Juliana Daniel

The Psychology Behind Social Comparisons

Social comparisons are an inherent part of human psychology. From a young age, individuals gauge their self-worth by comparing themselves to others. This behavior is deeply rooted in evolutionary biology, where assessing one's standing within a group was crucial for survival. In modern times, social comparisons have shifted from physical survival to emotional and financial well-being. The rise of social media has amplified this phenomenon, making it easier than ever to compare lifestyles, achievements, and financial statuses.

Psychologists have identified two primary types of social comparisons: upward and downward. Upward comparisons involve comparing oneself to those perceived as better off, while downward comparisons focus on those worse off. Both types can have significant financial implications. Upward comparisons often lead to feelings of inadequacy and a desire to "keep up with the Joneses," driving individuals to spend beyond their means. Conversely, downward comparisons can provide a sense of relief but may also lead to complacency in financial planning.

Understanding the psychology behind social comparisons is crucial for mitigating their financial impact. By recognizing the triggers and emotional responses associated with these comparisons, individuals can develop healthier financial habits and avoid the pitfalls of impulsive spending.

The Role of Social Media in Financial Comparisons

Social media platforms have become the primary arena for social comparisons, particularly in the realm of finances. Platforms like Instagram, Facebook, and TikTok are filled with curated images of lavish vacations, luxury cars, and designer clothing. These posts often create a distorted reality, where individuals perceive others as more successful and financially secure than they actually are.

The constant exposure to these idealized lifestyles can lead to financial anxiety and a sense of inadequacy. Many people feel pressured to emulate these lifestyles, even if it means taking on debt or sacrificing long-term financial goals. The "fear of missing out" (FOMO) is a powerful driver of impulsive spending, as individuals seek to replicate the experiences they see online.

However, it's important to remember that social media is a highlight reel, not an accurate representation of reality. Most people only share their best moments, leaving out the struggles and financial challenges they face. By maintaining a critical perspective and setting realistic financial goals, individuals can avoid the negative impact of social media-driven comparisons.

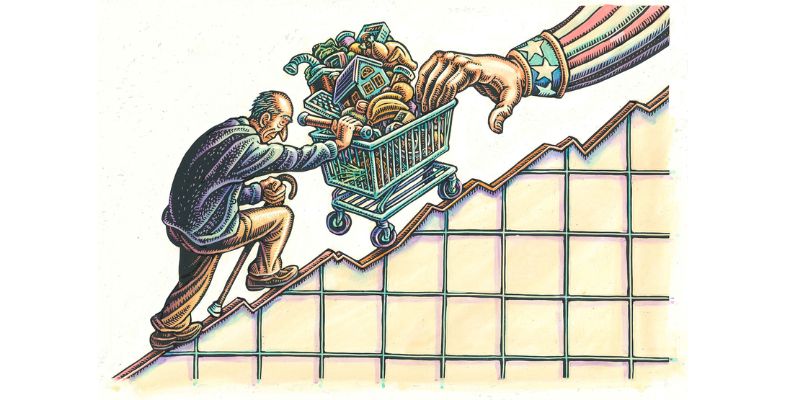

The Financial Consequences of Keeping Up with the Joneses

The desire to "keep up with the Joneses" is a common financial pitfall driven by social comparisons. This phenomenon refers to the tendency to match or exceed the spending habits of one's peers, often leading to unsustainable financial practices. Whether it's buying a bigger house, driving a fancier car, or taking more extravagant vacations, the pressure to maintain a certain lifestyle can have severe financial repercussions.

One of the most significant consequences of this behavior is the accumulation of debt. Credit cards, loans, and other forms of borrowing become tools for maintaining appearances, but they come with high interest rates and long-term financial burdens. Over time, this debt can spiral out of control, leading to financial stress and even bankruptcy.

Additionally, the focus on outward appearances can detract from more meaningful financial goals, such as saving for retirement, investing in education, or building an emergency fund. By prioritizing short-term gratification over long-term stability, individuals jeopardize their financial future.

To break free from the cycle of keeping up with the Joneses, it's essential to shift the focus inward. Setting personal financial goals based on individual values and priorities, rather than external comparisons, can lead to more sustainable and fulfilling financial practices.

How Social Comparisons Affect Spending Habits

Social comparisons have a profound impact on spending habits, often leading to irrational and impulsive financial decisions. When individuals compare themselves to others, they may feel compelled to spend money on items or experiences that they believe will elevate their social status. This behavior is particularly prevalent in consumer-driven societies, where material possessions are often equated with success and happiness.

One common example is the purchase of luxury goods. High-end brands often serve as status symbols, and owning these items can provide a temporary boost in self-esteem. However, the satisfaction derived from these purchases is usually short-lived, leading to a cycle of continuous spending in search of validation.

Another area where social comparisons influence spending is in the realm of experiences. Social media has made it easier than ever to share and compare experiences, from vacations to dining out. The desire to have the most Instagram-worthy experiences can lead to overspending on travel, entertainment, and dining, often at the expense of more practical financial needs.

To counteract the influence of social comparisons on spending habits, it's important to cultivate mindfulness and self-awareness. By understanding the emotional drivers behind spending, individuals can make more intentional and rational financial decisions.

The Long-Term Financial Impact of Social Comparisons

While the immediate effects of social comparisons on spending and debt are concerning, the long-term financial impact can be even more detrimental. Over time, the cumulative effect of impulsive spending and financial mismanagement can lead to significant financial instability. This instability can manifest in various ways, from a lack of savings to an inability to meet basic living expenses.

One of the most significant long-term consequences is the erosion of financial security. Individuals who prioritize maintaining appearances over building wealth may find themselves unprepared for unexpected expenses, such as medical emergencies or job loss. This lack of financial cushion can lead to increased stress and a diminished quality of life.

Additionally, the focus on short-term gratification can hinder long-term financial growth. Investments in education, retirement savings, and other wealth-building opportunities are often neglected in favor of immediate consumption. This can result in a lower net worth and reduced financial independence in later years.

To mitigate the long-term financial impact of social comparisons, it's crucial to adopt a proactive approach to financial planning. This includes setting clear financial goals, creating a budget, and prioritizing savings and investments over discretionary spending.

Strategies to Mitigate the Financial Impact of Social Comparisons

While social comparisons are a natural part of human behavior, there are strategies that individuals can employ to mitigate their financial impact. One effective approach is to cultivate a mindset of gratitude and contentment. By focusing on what one already has, rather than what others possess, individuals can reduce the desire to engage in competitive spending.

Another strategy is to set personal financial goals based on individual values and priorities. This involves identifying what truly matters in life and aligning financial decisions with these values. For example, someone who values experiences over material possessions may choose to spend money on travel rather than luxury goods.

Financial education is also a powerful tool in combating the negative effects of social comparisons. By understanding the principles of budgeting, saving, and investing, individuals can make more informed and rational financial decisions. This knowledge can empower individuals to resist the pressure to conform to societal expectations and instead focus on building long-term financial stability.

Finally, it's important to surround oneself with a supportive community that values financial responsibility. By engaging with like-minded individuals who prioritize financial health, one can reduce the influence of social comparisons and foster a more positive financial environment.

Unforgettable Pilgrimages: Top Temples in Andhra Pradesh

How to Invest in Gold and Precious Metals

How to Use Robo-Advisors for Retirement Planning

How to Use ETFs for Environmental, Social, and Governance (ESG) Investing

The Role of Research in Making Informed Investments

Discovering the Charm of Deià: A Travel Guide to Mallorca’s Hidden Gem

How to Use Options for Income Generation

How to Invest in Value Stocks for Long-Term Gains

Advertisement