The Role of Research in Making Informed Investments

How to Invest in Bonds for Stability and Income

How to Invest in Gold and Precious Metals

Emergency Funds 101: Why and How to Build One

The Pros and Cons of Margin Trading

Apr 24, 2025 By Juliana Daniel

Understanding Margin Trading: A Double-Edged Sword

Margin trading is a powerful financial tool that allows investors to borrow funds from a broker to trade larger positions than their capital would normally permit. This practice can amplify both gains and losses, making it a double-edged sword in the world of investing. While it offers the potential for significant profits, it also comes with substantial risks that can lead to severe financial consequences.

The Advantages of Margin Trading

One of the primary benefits of margin trading is the ability to leverage your investments. By borrowing funds, you can control a larger position in the market than your actual capital would allow. This can lead to higher returns if the market moves in your favor. Additionally, margin trading provides flexibility, allowing investors to take advantage of short-term trading opportunities without needing to liquidate other assets.

Another advantage is the potential for diversification. With increased buying power, investors can spread their investments across a wider range of assets, reducing the risk associated with putting all their eggs in one basket. This can be particularly useful in volatile markets where diversification can help mitigate losses.

The Risks of Margin Trading

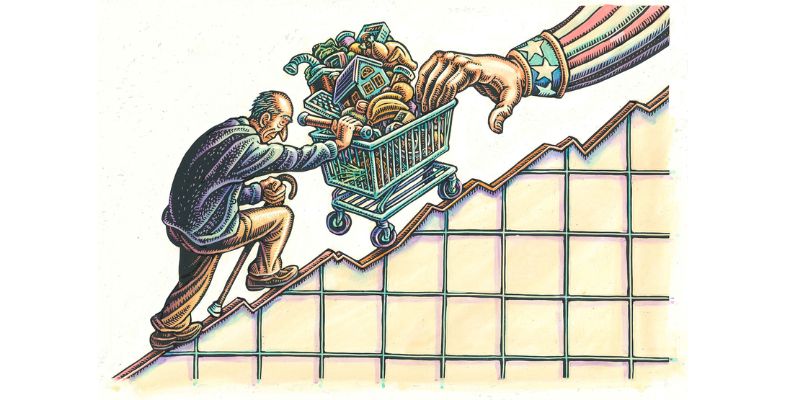

While the potential for higher returns is enticing, margin trading also comes with significant risks. The most obvious risk is the potential for amplified losses. If the market moves against your position, you could lose more than your initial investment. This can lead to margin calls, where the broker demands additional funds to cover the losses, potentially forcing you to liquidate assets at an inopportune time.

Another risk is the cost of borrowing. Margin trading involves paying interest on the borrowed funds, which can eat into your profits. Additionally, the market can be unpredictable, and even experienced traders can find themselves on the wrong side of a trade. The psychological pressure of managing leveraged positions can also lead to poor decision-making, further increasing the risk of losses.

Margin Trading Strategies for Success

To mitigate the risks associated with margin trading, it’s essential to have a well-thought-out strategy. One common approach is to use stop-loss orders, which automatically sell a position if it reaches a certain price, limiting potential losses. Another strategy is to maintain a diversified portfolio, spreading your investments across different asset classes to reduce risk.

Risk management is also crucial. This includes setting a clear budget for how much you’re willing to lose and sticking to it. It’s also important to stay informed about market conditions and to continuously monitor your positions. Education and experience are key, so it’s advisable to start with smaller positions and gradually increase your exposure as you become more comfortable with margin trading.

Regulatory Considerations in Margin Trading

Margin trading is subject to various regulations designed to protect investors and maintain market stability. These regulations can vary by country and include requirements for minimum margin levels, restrictions on the types of assets that can be traded on margin, and rules governing margin calls. It’s important for investors to be aware of these regulations and to ensure that they are in compliance to avoid legal issues.

Brokers also play a role in enforcing these regulations, and they may have their own additional requirements. This can include higher margin requirements for certain assets or restrictions on trading during periods of high volatility. Understanding these rules and how they apply to your trading activities is essential for managing risk and avoiding unexpected complications.

Psychological Aspects of Margin Trading

The psychological impact of margin trading should not be underestimated. The pressure of managing leveraged positions can lead to stress and anxiety, which can cloud judgment and lead to poor decision-making. It’s important to maintain a disciplined approach and to avoid letting emotions dictate your trading decisions.

One way to manage this is to set clear goals and stick to them. This includes having a predefined exit strategy for both winning and losing trades. It’s also helpful to take breaks and to avoid over-trading, as this can lead to burnout and increased risk of mistakes. Building a support network of fellow traders can also provide valuable insights and help you stay grounded.

Margin Trading in Different Market Conditions

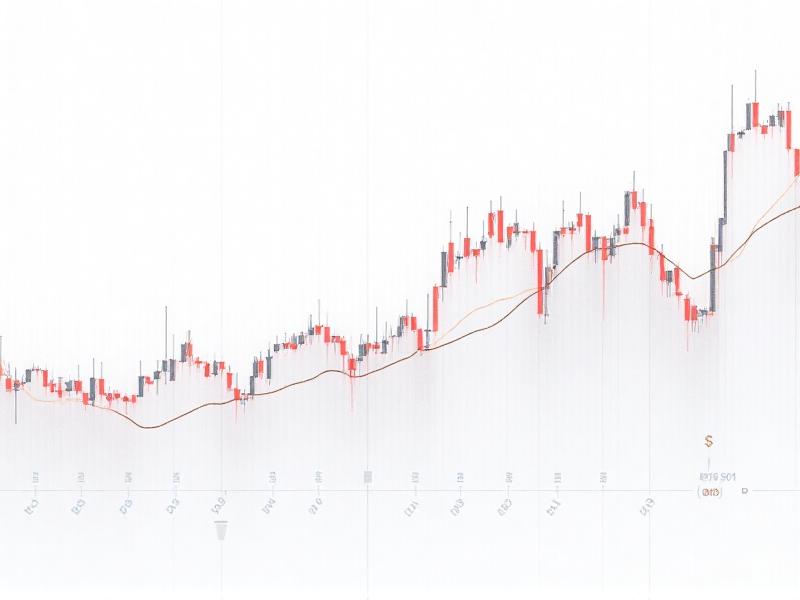

Market conditions can have a significant impact on the success of margin trading. In bull markets, where prices are rising, margin trading can be highly profitable as the leverage amplifies gains. However, in bear markets, where prices are falling, the same leverage can lead to significant losses.

It’s important to adjust your strategy based on market conditions. This may include reducing leverage during periods of high volatility or avoiding margin trading altogether in uncertain markets. Staying informed about economic indicators and market trends can help you make more informed decisions and reduce the risk of losses.

Long-Term vs. Short-Term Margin Trading

Margin trading can be used for both long-term and short-term investment strategies. Long-term margin trading involves holding positions for extended periods, often with the goal of capitalizing on long-term market trends. This approach can be less risky than short-term trading, as it allows more time for the market to recover from any downturns.

Short-term margin trading, on the other hand, involves taking advantage of short-term price movements. This can be more risky, as it requires precise timing and a deep understanding of market dynamics. However, it can also be more profitable if executed correctly. It’s important to choose the approach that best aligns with your investment goals and risk tolerance.

Tools and Resources for Margin Traders

There are numerous tools and resources available to help margin traders make informed decisions. These include trading platforms that offer real-time data and analysis, as well as educational resources that provide insights into market trends and trading strategies. It’s important to take advantage of these resources to improve your trading skills and increase your chances of success.

Additionally, many brokers offer tools such as margin calculators, which help you determine the amount of margin required for a particular trade. There are also risk management tools, such as stop-loss orders and position sizing calculators, that can help you manage your risk more effectively. Utilizing these tools can help you make more informed decisions and reduce the likelihood of losses.

Ethical Considerations in Margin Trading

Margin trading also raises ethical considerations, particularly in terms of the impact on market stability and the potential for predatory practices. Some critics argue that margin trading can contribute to market volatility, as leveraged positions can lead to rapid price swings. Additionally, there is the potential for brokers to take advantage of inexperienced traders by encouraging excessive leverage.

It’s important for traders to be aware of these ethical issues and to approach margin trading with a sense of responsibility. This includes being transparent about the risks involved and ensuring that you are not engaging in practices that could harm the market or other investors. Ethical trading practices not only protect you but also contribute to a more stable and fair market environment.

Future Trends in Margin Trading

The landscape of margin trading is constantly evolving, with new technologies and regulations shaping the future of the industry. One significant trend is the increasing use of artificial intelligence and machine learning to analyze market data and predict price movements. These technologies can provide traders with more accurate insights and help them make more informed decisions.

Another trend is the growing popularity of decentralized finance (DeFi) platforms, which offer margin trading without the need for traditional brokers. These platforms can provide greater transparency and lower costs, but they also come with their own set of risks. As the industry continues to evolve, it’s important for traders to stay informed about these trends and to adapt their strategies accordingly.

How to Use Futures Contracts for Hedging

Social Security and Cost-of-Living Adjustments (COLA)

How to Save Money on Home Appliances

The Pros and Cons of Margin Trading

How to Use Fintech for Debt Management

The Role of AI in Financial Planning

How to Use Robo-Advisors for Retirement Planning

The Role of AI in Wealth Management

Advertisement